An In-Depth Analysis of the Dynex Project (DNX): Technology, Team, and Reliability Assessment

!!! Attention, attention, this is very long read, cca 20 pages! This is full summary of what whole Interwebz is thinking about Dynex, not my own opinion. !!! Numbers after dots are citations.

I. Executive Summary

(This section summarizes the key findings of the report and is typically written last. It will provide a high-level overview of Dynex’s identity, technology, leadership controversies, market standing, security posture, adoption claims, and overall reliability assessment based on the detailed analysis in subsequent sections.)

The Dynex project, associated with the Dynexcoin (DNX) token, presents itself as a revolutionary platform leveraging neuromorphic quantum computing principles on a decentralized network of GPUs via a Proof-of-Useful-Work (PoUW) consensus mechanism. It aims to provide computational power for solving complex real-world problems across various industries. However, a deep dive reveals significant discrepancies between the project’s ambitious claims and verifiable evidence. While a public-facing team led by Co-founder Daniela Herrmann is presented, persistent and specific allegations link the project’s origins to Daniel Mattes, an entrepreneur with a history of settling SEC charges for investor fraud. The project’s core technology, particularly the proprietary DynexSolve algorithm and the PoUW implementation, remains closed-source and lacks independent verification, raising concerns about its feasibility and security. Security audits performed have a limited scope, excluding these critical components. Market performance has been extremely volatile, with DNX experiencing a significant price decline from its peak, and it lacks listing on top-tier exchanges. Numerous partnerships are announced, but their commercial substance and scale are largely unverified. Community sentiment is highly polarized, with significant skepticism driven by the leadership concerns, lack of transparency, and specific allegations including potential plagiarism. Overall, the Dynex project exhibits numerous red flags, including critical transparency issues, unresolved leadership questions tied to past financial misconduct, and unverified technological claims. These factors combine to represent a high-risk profile, making it difficult to assess the project as reliable based on the currently available public information.

II. Introduction to Dynex (DNX): Project Identification and Stated Goals

A. Defining the Dynex Project

The subject of this analysis is the Dynex project, identifiable by its native cryptocurrency token, Dynexcoin (DNX), and primarily represented online through the websites dynexcoin.org and dynex.co.1 The project reportedly initiated with a “fair launch” in September 2022, with its mainnet going live on September 16th, 2022.1 Dynex positions itself at the intersection of blockchain technology and high-performance computing, specifically targeting the domain of neuromorphic and quantum computing principles.

B. Distinguishing from Other “Dynex” Entities

It is crucial to differentiate the Dynex (DNX) blockchain project from several other established, unrelated corporations that share the “Dynex” name. The prevalence of these entities across diverse sectors necessitates clear identification to avoid confusion. These unrelated companies include:

- Dynex Capital, Inc. (NYSE: DX): A publicly traded mortgage Real Estate Investment Trust (REIT) focused on residential and commercial real estate investments.5

- Dynex Technologies: A company specializing in ELISA (Enzyme-Linked Immunosorbent Assay) automated testing systems for laboratories.8

- Dynex/Rivett Inc. (Dynex Hydraulics): A manufacturer of high-pressure hydraulic components like pumps, valves, and power units.11

- Dynex Semiconductor Ltd: A UK-based company producing high-power semiconductor devices (IGBTs, Bipolar devices) for applications like renewables, traction, and industrial uses.14

- Dynex USA: A manufacturer of engineering plastic stock shapes.15

- Dynex Energy S.A.: A Luxembourg-based investment company focused on oil and gas property acquisition and development in the US.16

- Dynex Battery: An Indian brand of automotive and inverter batteries.17

- Dynex (Brand): Associated with consumer electronics accessories, such as CD/DVD sleeves sold via retailers.18

This report focuses exclusively on the blockchain and computing project associated with Dynexcoin (DNX).1

C. Stated Mission and Technology

Dynex articulates a mission to create and operate the “world’s only accessible neuromorphic quantum computing cloud” or a “neuromorphic supercomputing platform”.19 The central claim is that this platform can solve complex, real-world computational problems at scale, potentially exceeding the capabilities of existing quantum computers in certain domains.19

This is purportedly achieved through a novel technological stack:

- Decentralized Network: Utilizing the combined power of a globally distributed network of Graphics Processing Units (GPUs) contributed by miners.1

- Proprietary Algorithm (DynexSolve): A core, proprietary algorithm that allegedly enables the emulation of neuromorphic computing chips on standard GPU hardware.19 It forms the foundation of their consensus mechanism.

- Proof-of-Useful-Work (PoUW): Instead of traditional Proof-of-Work (PoW) mining that solves arbitrary puzzles, Dynex employs PoUW, where the computational effort of the miners is directed towards solving practical problems submitted by customers or the platform itself.3

The stated goal is to apply this computational power to address challenges in diverse fields such as Artificial Intelligence (AI), pharmaceutical discovery, financial modeling, automotive and aerospace design, telecommunications, and scientific research.1

D. Website Differentiation: dynexcoin.org vs. dynex.co

The project maintains two distinct primary web domains, dynexcoin.org and dynex.co, which appear to target different audiences and aspects of the project.1

- dynexcoin.org: This site seems primarily focused on the cryptocurrency aspect of the project. It details the DNX token, provides resources for mining, lists available wallets, highlights the “fair launch” principles, links to community channels (Discord, GitHub, X/Twitter), and presents information on tokenomics and the blockchain itself.1 It caters more towards miners, token holders, and the general crypto community.

- dynex.co: This domain emphasizes the commercial and technological service offering, branding it as “Quantum-as-a-Service” (QaaS).2 It showcases enterprise use cases, details partnerships and customer engagements, provides access to the Dynex Software Development Kit (SDK), lists scientific papers, outlines the technology roadmap (including planned chip releases like Apollo and Athene), and generally targets potential users of the computational platform, such as businesses and researchers.2

The existence of these two websites suggests a deliberate marketing strategy to segment communication. While potentially effective in reaching different groups, it also raises questions about the project’s primary focus – whether it is driven more by the cryptocurrency (DNX) and its community or by the development and sale of its computational services. This duality requires careful consideration when evaluating the project’s overall objectives and viability.

III. Leadership and Team Analysis

A critical aspect of evaluating any project, particularly in the often-opaque world of cryptocurrency, is understanding the team behind it. Dynex presents a complex picture regarding its leadership, with a publicly acknowledged team coexisting alongside persistent allegations of hidden influence by a controversial figure.

A. Publicly Acknowledged Team

The official Dynex websites (dynexcoin.org and dynex.co) present a leadership structure and advisory board, claiming a total team size of 67 professionals with a strong focus on scientific and quantum expertise.31 Key individuals highlighted include:

- Daniela Herrmann (Co-Founder): Presented as a central figure, Herrmann is described as the founder of the Topan® Ecosystem, bringing expertise in sustainability, fintech, blockchain, quantitative strategies, and big data analytics.31 She is positioned as a leader focused on “innovation for global good” and ethical considerations, often linked to “Dynex Moonshots,” described as the strategic, investment, and ethical steward of the ecosystem.32 Her background includes degrees from the University of St. Gallen and the University of Zurich, previous executive roles in finance (including SRI asset management), and nominations for awards like the WomenTech Global Awards.32 She has represented Dynex in interviews and at events.36

- Clifford Mapp (Global Head of Ecosystem Development & Information Security): Noted as an authority in blockchain and IT security, responsible for the platform’s security architecture.21

- Other Listed Individuals: The websites also list other heads of departments and advisors, including Rodrigo de Sá (Academia), Ivan Petliokha (Platform Development), Samer Rahmeh (Quantum Solutions Architecture), Hok Chi (Adam) Au (Innovation & Science), Gregory Carson (Advisor, Strategic Affairs), Dan Voicu (Advisor, Technology & Research, formerly Microsoft), and Sheldon Inwentash (Advisor, Business Development, CEO of ThreeD Capital).31

This publicly presented team comprises individuals with backgrounds in relevant fields like finance, technology, security, and business development.

B. Anonymity Concerns and the Daniel Mattes Allegations

Despite the listed team members, Dynex is frequently described in online discussions and analyses as having an anonymous founding team or being a “black box” project where the core leadership and development origins are obscured.25 This perception stems largely from persistent and specific allegations that the project was founded or is significantly controlled by Daniel Mattes, an Austrian internet entrepreneur and venture capitalist.25 Some sources even associate Mattes with the alias “Sumitomo” within the Dynex context.4

These allegations are not mere speculation; they are often presented with specific, though sometimes circumstantial, evidence, such as analyses attempting to link code or project history to Mattes.41 The project itself, according to the available information, has not publicly and directly addressed or refuted these specific allegations concerning Daniel Mattes’ involvement. This silence allows the narrative to persist and fuels skepticism.

C. Daniel Mattes’ Background and SEC Settlement

The allegations surrounding Daniel Mattes gain significant weight due to his documented history with US regulatory authorities. Mattes founded Jumio Inc., an online authentication and mobile payments company, in 2010.45 In April 2019, the U.S. Securities and Exchange Commission (SEC) charged Mattes with defrauding Jumio investors.45

According to the SEC’s complaint:

- Mattes grossly overstated Jumio’s revenues for 2013 and 2014.45 For instance, revenues were reported as $251 million over two years when they were actually $17.2 million.49 Net losses were reported as $9.7 million instead of the actual $36 million.49

- Subsequent to these misrepresentations, Mattes sold approximately $14 million worth of his personal Jumio shares to investors in the private secondary market.45

- Mattes concealed these personal share sales from Jumio’s board of directors.45

- He falsely told at least one investor he was not selling his shares, stating “he’d be stupid to sell at this point” due to upcoming positive developments.46

Jumio eventually restated its financials in 2015, wiping out most of the previously claimed revenue, and filed for bankruptcy protection in 2016.46 Mattes resigned as CEO in April 2015 amid an internal investigation.46

Without admitting or denying the SEC’s allegations, Mattes agreed to a settlement requiring him to pay over $17 million in disgorgement, prejudgment interest, and penalties.45 He was also permanently barred from serving as an officer or director of a publicly traded company in the U.S..47 Jumio’s former CFO, Chad Starkey, also settled related charges with the SEC.46 The successor company, Jumio Corp, stressed that it had severed ties with Mattes and Starkey in 2015.51

D. Analysis of Leadership Credibility

The leadership situation presents significant challenges to Dynex’s credibility. There is a fundamental conflict between the official narrative showcasing a team led by Daniela Herrmann 31 and the persistent, detailed allegations pointing towards Daniel Mattes’ central role.25 The project’s failure to directly confront and clarify these specific allegations creates an environment of uncertainty and suspicion. Potential stakeholders are left to weigh the official presentation against a compelling counter-narrative backed by external claims and, crucially, Mattes’ documented history. This ambiguity itself constitutes a major risk factor.

Furthermore, the nature of the SEC settlement involving Daniel Mattes is particularly damaging. The charges were not minor infractions but involved deliberate misrepresentation of financial performance and hidden self-dealing that directly harmed investors and contributed to a company’s bankruptcy.45 If the allegations of his involvement in Dynex are true, it implies that an individual with a proven history of prioritizing personal gain over transparency and investor interests could be guiding the project. This elevates the potential “scam risk” substantially, linking it to specific past actions rather than just general industry concerns.

Additionally, the claim of a 67-person team 31 appears somewhat at odds with the simultaneous concerns about anonymity 25 and the limited public visibility of individuals beyond the named leadership and advisors. If such a large team exists, the reasons for the perceived opacity and the focus on only a few individuals are unclear. This could suggest either an exaggeration of the team’s operational scale or a deliberate effort to obscure the identities of those performing the core development work, further eroding transparency.

IV. Technology Deep Dive: Neuromorphic Computing and Proof-of-Useful-Work (PoUW)

Dynex’s core value proposition rests on its claims of technological innovation, specifically in emulating neuromorphic quantum computing and implementing a Proof-of-Useful-Work consensus mechanism.

A. Core Concept: Neuromorphic Quantum Computing Emulation

Dynex claims to be a platform for neuromorphic computing, sometimes termed “neuromorphic quantum computing”.1 Neuromorphic computing draws inspiration from the structure and function of the biological brain.19 Dynex asserts that its platform can emulate aspects of this, and even quantum computing phenomena like entanglement and tunneling 20, using conventional hardware, primarily GPUs distributed across its network.1

The project literature mentions utilizing concepts like simulating the ion drift effects typically observed in memristors (memory resistors).2 Memristors are theoretical (and increasingly practical) electronic components whose resistance depends on the history of current that has passed through them. Dynex claims its proprietary chip design (simulated on GPUs) is based on ideal memristors and involves solving Ordinary Differential Equations (ODEs) that model their behavior.24

Central to this emulation is the concept of “algorithmic qubits”.2 These are presented as the neuromorphic counterpart to the physical qubits used in traditional quantum computers. Unlike binary bits (0 or 1) or the quantum states of physical qubits, algorithmic qubits are described as having states that vary continuously between -1.0 and +1.0 volts, allowing them to exhibit a form of superposition.2 Problems are mapped onto neuromorphic gate circuits designed to find low-energy solutions, analogous to quantum annealing or tunneling effects.2 Dynex claims this approach allows operation at room temperature, avoiding the cryogenic requirements of many physical quantum computers.2

B. DynexSolve Algorithm

The engine behind this claimed emulation is the DynexSolve algorithm.19 This is described as a proprietary, core algorithm that enables the PoUW mechanism and purportedly transforms any modern GPU into multiple simulated neuromorphic computing chips.19 Dynex claims that computations performed using DynexSolve can be orders of magnitude faster than classical methods and even outperform current quantum computers for a range of applications.19 However, the specifics of how DynexSolve achieves this transformation and acceleration are not publicly disclosed, as the algorithm is closed-source.25

C. Proof-of-Useful-Work (PoUW) Mechanism

Dynex employs a Proof-of-Useful-Work (PoUW) consensus mechanism, aiming to address the criticism that traditional PoW (like Bitcoin’s) consumes vast amounts of energy on computations (hashing) that have no external value beyond securing the network.22

In Dynex’s model, the computational power of the participating miners’ GPUs is directed towards solving potentially useful tasks submitted by external customers or the platform itself.3 These tasks are claimed to align with the platform’s neuromorphic computing capabilities, tackling problems in areas like AI, optimization, and scientific research.21

The incentive structure for miners is described as potentially multi-faceted, including 22:

- Block Rewards: Standard rewards for creating new blocks on the blockchain (paid via mining pools).56

- Transaction Fees: Fees associated with transactions included in blocks.

- Computation Fees: Payments made by customers who submit computational tasks to the network.

- Solution Rewards: Potential additional rewards for successfully solving specific, valuable problems.

According to some discussions, the rewards for the “useful work” (computation fees/solution rewards) are handled by a system called “Mallob” (Malleable Load Balancer) and are paid directly to the miners’ wallets, bypassing the traditional mining pool payout for block rewards.42

D. Verification Challenges and Criticisms

While the concept of PoUW is appealing, it faces significant theoretical and practical challenges, which are relevant to assessing Dynex’s claims:

- Verification Problem: A fundamental hurdle for PoUW is verifying that the submitted work is correct, was actually performed (not faked), and meets the required specifications. This verification process must be significantly faster and less resource-intensive than the original computation itself; otherwise, the efficiency gains are lost.57 Verifying complex computations like ML model training or scientific simulations is inherently difficult.57

- Standardization and Comparability: Useful tasks can vary dramatically in complexity, input data size, and required computation time. Creating a fair system for rewarding miners requires standardizing these diverse work units, which is challenging.25 How does one compare the “work” involved in solving a small optimization problem versus contributing to a large ML training job?

- Difficulty Adjustment: Blockchains require mechanisms to adjust the mining difficulty to maintain a stable block production time (e.g., Bitcoin’s ~10 minutes). In PoUW, the “difficulty” is tied to the complexity of the useful tasks, which may be supplied irregularly and vary widely in computational demands, making stable block times hard to achieve.57

- Centralization Risks: If the process of task submission, definition, or verification becomes centralized (e.g., controlled by the project team or a few large customers), it undermines the decentralized nature of the blockchain.

These general PoUW challenges are compounded in Dynex’s case by a lack of transparency. Criticisms highlight that the Dynex implementation operates as a “black box”.25 There is little public information on:

- How external customers actually submit tasks.

- What the specific “3,300 tasks” reportedly completed actually entailed.25

- Crucially, how the correctness and validity of the submitted useful work are verified by the network before rewards are issued.25

The reliance on the proprietary, closed-source DynexSolve algorithm 25 prevents independent scrutiny of the core computational and verification logic. The description of the Mallob system handling direct payments for useful work 56 adds another layer of proprietary infrastructure without resolving the fundamental question of how the validity of that work is established trustlessly across the decentralized network. The project has not publicly demonstrated how it overcomes the well-documented verification and standardization challenges inherent to PoUW.

Furthermore, the project’s heavy reliance on sophisticated terminology (neuromorphic, quantum computing, memristors, algorithmic qubits, PoUW) 1 combined with the lack of transparency has led to accusations of using “technobabble”.25 While potentially representing genuine innovation, this complex language makes it difficult for external experts to assess the claims, especially without access to the underlying code or detailed, peer-reviewed publications on the core mechanisms. This opacity, viewed alongside other red flags, raises concerns about potential misrepresentation.

E. Scientific Publications and Roadmap

To bolster its technical credibility, Dynex points to scientific papers authored by its researchers, a Dynex SDK for developers, and planned future hardware releases.26 The website mentions publications in outlets like the “International Journal of Bioinformatics” and others related to specific applications like Quantum Restricted Boltzmann Machines or solving optimization problems.26 A Dynex SDK based on Python is available on GitHub, allowing users to formulate problems for the platform.24

The project has also outlined a hardware roadmap, including plans to release silicon-based chips:

- Apollo: Planned for 2025, featuring 1,000 algorithmic qubits, designed for real-time operation at room temperature.2

- Athene: Planned for 2026, intended as the first commercially available chip, supporting up to 10,000 algorithmic qubits.2

However, the actual impact and validation level of the cited scientific publications remain unclear. Publishing papers, especially on platforms like arXiv or in less prominent journals, does not necessarily equate to rigorous, independent peer review and validation of groundbreaking claims.62 Critiques specifically note the absence of any public, peer-reviewed paper detailing the revolutionary DynexSolve algorithm itself.25 Therefore, while Dynex presents markers of scientific activity, the evidence provided appears insufficient to independently verify the core technological breakthroughs claimed, particularly concerning the PoUW mechanism and the performance of DynexSolve.

V. Dynexcoin (DNX) Tokenomics and Market Performance

The Dynexcoin (DNX) token is central to the project’s ecosystem, serving as both a utility token and a speculative asset.

A. Token Utility

DNX is designated as the native utility coin of the Dynex platform.3 Its primary functions are:

- Payment for Computation: Customers seeking to utilize the network’s neuromorphic computing capabilities must pay for this computation time using DNX tokens.4

- Miner/Provider Compensation: DNX is used to reward the miners (or compute providers) who contribute their GPU resources to the network, both through block rewards and potentially through direct payments for completing useful work tasks.3

The token is divisible into smaller units called nanoDNX (10−9 DNX).3

B. Supply and Emission

Dynex has a fixed maximum supply of 110,000,000 DNX tokens.1 The project claims a deflationary emission schedule, governed by the formula BaseReward=(MSupply−A)≫18, where MSupply is the maximum supply and A is the amount of previously generated coins.3 This formula implies that the block reward decreases as the circulating supply (A) increases.

Information on the current circulating supply is available through blockchain explorers and third-party data aggregators like CoinMarketCap and CoinGecko.3 Analysis of data from late 2024 and early 2025 indicates a circulating supply of approximately 100 million to 102 million DNX.20 This means that roughly 91-93% of the total maximum supply was already in circulation within about 2.5 years of the project’s launch in September 2022.

This rapid emission rate suggests that the majority of potential token inflation from mining rewards has already occurred. Consequently, future appreciation in DNX value would need to be driven primarily by increased demand for the token (either for platform utility or speculation) rather than by dynamics of diminishing supply issuance.

C. Fair Launch Claim

A significant narrative point emphasized by Dynex is its “fair launch”.1 The project explicitly states there was no Initial Coin Offering (ICO), no pre-mining of tokens before the public launch, and no pre-allocation of coins to the development team or early investors.1 This approach is often favored within the cryptocurrency community as it theoretically provides a more level playing field for acquiring tokens compared to projects with large insider allocations.

However, the credibility of this claim is somewhat clouded by the leadership anonymity concerns and the allegations surrounding Daniel Mattes.25 Even without a formal pre-mine or ICO, if undisclosed founders or early participants were involved from the beginning, they could have potentially mined or acquired substantial amounts of DNX during the initial, lower-difficulty phases of the network. This could lead to significant early concentration of supply, potentially undermining the spirit, if not the letter, of a “fair” distribution. While token holder data for the native chain is not readily available in the provided materials 74, the context of anonymity warrants caution in accepting the “fair launch” claim at face value without independent verification of early distribution patterns.

D. Market Data Analysis

The market performance of DNX has been characterized by significant volatility and a subsequent major downturn following an earlier peak.

- Price History: DNX experienced a substantial price surge, reaching an all-time high (ATH) reported between $1.36 and $1.39 USD in November 2023.20 However, data from subsequent periods (early to mid-2025 in the snippets) show the price collapsing to levels around $0.03 to $0.06 USD.20 This represents a decline of over 90% from its peak.54

- Market Capitalization: Reflecting the price drop, the market capitalization in later periods is reported in the low single-digit millions USD range (approx. $3M – $6M).20 This places DNX well outside the top-ranked cryptocurrencies by market cap, often cited with a rank beyond #1000.20

- Trading Volume: Daily trading volume appears relatively low, typically reported in the range of a few hundred thousand US dollars.20 Low volume can contribute to price volatility and make it difficult to execute large trades without significant price impact (slippage).

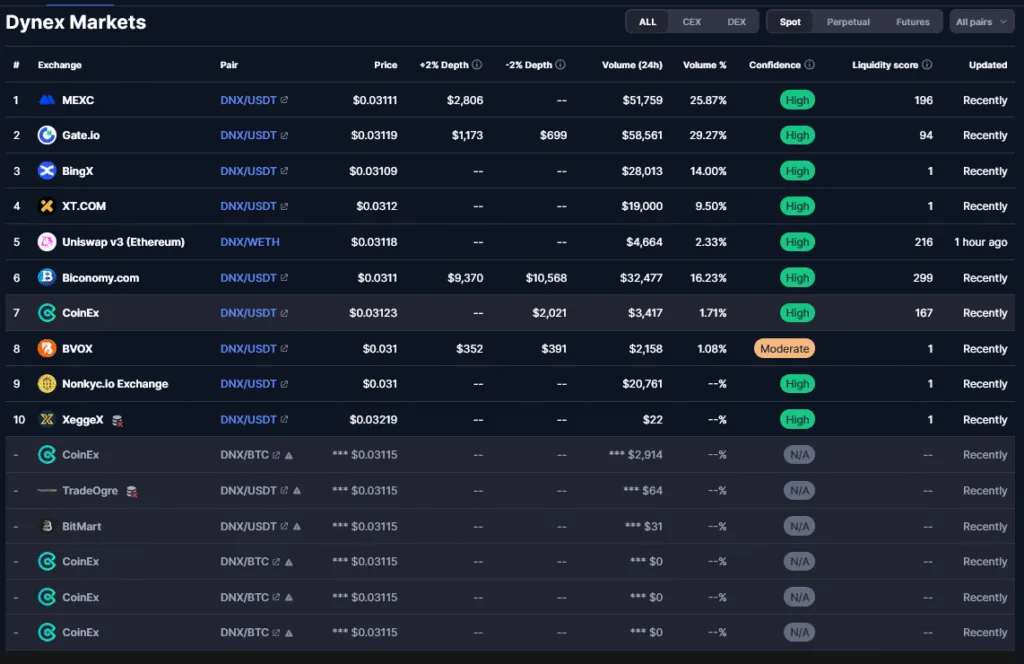

- Exchange Listings: DNX is available for trading on a number of centralized (CEX) and decentralized (DEX) exchanges. A consolidated view is presented below. Notably, DNX is not listed for trading on top-tier exchanges such as Binance or Coinbase.54 Lack of listing on major exchanges limits accessibility for a broader market and can hinder liquidity.

Note: Volume data is indicative and subject to change.

This table highlights that while DNX is accessible on several mid-to-lower tier exchanges, its primary liquidity appears concentrated on MEXC and Gate.io, with relatively low overall volume compared to more established cryptocurrencies.

VI. Security Audits and Codebase Review

Security is paramount for blockchain projects, involving audits of smart contracts and, ideally, the underlying codebase. Dynex’s approach to security audits and code transparency presents a mixed picture.

A. Audit Provider and Scope

The primary third-party auditor mentioned in project materials and external sources is Cyberscope.3 Cyberscope is a known entity within the crypto auditing space, recognized by launchpads and listing sites.75

The scope of the audits conducted by Cyberscope appears to cover certain components of the Dynex ecosystem:

- ERC-20 Token Contract: An audit likely exists for the Ethereum-based representation of DNX (address 0x9928…ceAf13), used for trading on DEXs like Uniswap.20

- Wallets: The project claims that its self-custody wallets (Web, GUI, CLI) have also undergone rigorous evaluation by Cyberscope.3

However, a critical assessment reveals a significant limitation: due to the closed-source nature of the project’s core components, these audits almost certainly do not cover the fundamental Layer 1 blockchain code (written in C++) or, crucially, the proprietary DynexSolve PoUW algorithm.24 Auditing firms can only assess the code they are provided access to. Auditing peripheral components like wallets or an ERC-20 token contract provides some assurance but does not validate the security or functionality of the novel, core technology upon which the project’s entire premise rests.

B. Audit Findings

Dynex highlights the results of its Cyberscope audits, stating they were “successfully completed with no critical or medium-level findings”.3 The Cyberscope audit summary page for Dynex (DNX) corroborates this for the latest iteration reviewed 74, showing:

- 0 Critical findings

- 0 Medium findings

- 10 Minor findings 74

There is ambiguity regarding the resolution status of the minor findings. Snippet 74 lists “10 Unresolved” next to the “10 Minor” count for the January 19, 2025 iteration. However, snippet 74, interpreting the same source page, states “0 unresolved findings” overall. Access to the full PDF audit report 74 would be necessary to clarify the exact nature and status of these minor issues. Regardless, the absence of critical or medium findings in the audited components is a positive point, within the limited scope of the audit.

C. Codebase Transparency

A major point of concern is the lack of transparency regarding Dynex’s core codebase. While some components, like the Dynex SDK 24 and public repositories for website or general information exist 22, the crucial elements are kept private:

- DynexSolve Algorithm: The code for the proprietary PoUW algorithm is not open source.24 A reference implementation miner was shared on GitHub with redacted communication handlers, explicitly stated as being for educational purposes only and not buildable without the missing parts.24

- Core L1 Node Software: It is implied that significant portions of the core blockchain node software are also closed-source or not publicly available for review.25

This contrasts sharply with the standard practice in the blockchain industry, where open-source code is considered essential for building trust, enabling independent security verification, and fostering community development.

D. Security Analysis

The security posture of Dynex is significantly weakened by the lack of transparency. Promoting the Cyberscope audits without explicitly stating that they do not cover the core, novel technology (PoUW algorithm, L1 consensus) can create a misleading impression of comprehensive security validation. Users might assume the entire system has been vetted, when in reality, the most critical and potentially vulnerable parts remain unaudited by independent third parties.

The closed-source nature of DynexSolve and the core L1 code prevents the broader security community from reviewing the implementation for flaws, backdoors, or inconsistencies between claimed functionality and actual operation. This forces users and investors to place a high degree of trust in the (partially anonymous) development team. For a project claiming decentralization and relying on complex, unproven technology, this lack of transparency is a major red flag and a significant security risk. The integrity and security of the entire network depend on code that cannot be independently verified.

Table 2: Summary of Publicly Known Dynex Audits

Note: Scope limitations regarding closed-source core components are inferred based on standard audit practices and project descriptions.

VII. Partnerships, Ecosystem, and Adoption

Dynex actively promotes partnerships and outlines an ecosystem structure to demonstrate traction and real-world applicability for its claimed computational capabilities.

A. Claimed Partnerships

The project websites list a variety of partnerships across different sectors 4:

- Technology & Engineering: SilverStone & Partners (Engineering, Design, Manufacturing), Vee Technologies (Technology Solutions), Finserv Experts (FSE – Consultancy), nuco.cloud (Decentralized Cloud Reseller), Octaspace (AI/Quantum Computing).

- Research & Academia: InCor (Instituto do Coração, University of São Paulo Medical School – Healthcare AI), Sona College of Technology (India – Quantum Computing Curriculum), Etica (Medical Research Protocol – received compute credits).

- Finance & Fintech: Ubuntu Group / Ubuntu Tribe (Gold-backed Assets, Financial Empowerment).

- Environmental: Bluebell Index (Environmental Fintech, Asset Certification).

- Infrastructure & Design: Afniah (Architecture/Design Innovation), Resilienture (Coastal Resilience Projects).

- Other: Involvement claimed in European Le Mans Series (Motorsports) and development of Italy’s first Hyperloop prototype (Transportation).

This diverse list aims to showcase the versatility of the Dynex platform.

B. Ecosystem Description

Dynex describes its ecosystem as a network of stakeholders working together 79:

- Customers: Organizations using Dynex quantum computing for problem-solving.

- Certified Integration Partners: Consultancy firms helping customers implement Dynex solutions.

- Universities and Academia: Research and education partners, fostering innovation and talent.

- Dynex Moonshots: Positioned as the “investment, strategic, and ethical steward,” led by Daniela Herrmann, investing in related ventures and initiatives.32

- Decentralized Miners/Nodes: Providers of the core GPU computing power via the PoUW blockchain.

- Media Partners: Outlets helping to disseminate information about Dynex.

This framework portrays a collaborative environment driving the adoption and development of Dynex technology.

C. Evidence of Real-World Use

Evaluating the substance behind these claims is challenging based solely on announcements. Some specific examples are provided:

- A case study describing enhanced weather prediction using a quantum diffusion model for a customer involved in WTI (West Texas Intermediate) oil trading.33

- The partnership with InCor involves leveraging Dynex technology to train AI models on healthcare datasets for precision medicine.33

- The Etica partnership involved a donation of 100,000 DNX worth of computing credits.4

- The Sona College collaboration is supported by a 3-year Dynex subscription grant from Dynex Moonshots.33

These examples suggest some level of engagement, but distinguishing between paid commercial contracts, pilot projects, grant-funded initiatives, or purely strategic/marketing partnerships is difficult without further information. The core premise remains that customers pay for computation time in DNX.4

D. Adoption Analysis

While the sheer number of announced partnerships is noteworthy and covers an impressive range of industries, their actual depth and commercial significance remain largely unverified from the provided materials. Several engagements appear to be non-commercial, involving grants or donated resources (Sona College, Etica) 4, which, while potentially valuable for showcasing capabilities, do not represent market adoption in the traditional sense. The language used in announcements (“strategic joint venture,” “partnership,” “user”) can be ambiguous. There is a lack of publicly available, quantifiable data regarding revenue generated from these partnerships or the actual volume of computation being purchased by paying customers. Therefore, it is plausible that many of these collaborations are in early stages (e.g., pilots, proof-of-concepts) or serve primarily marketing purposes rather than indicating widespread, large-scale commercial deployment and revenue generation.

The role of “Dynex Moonshots” 32 adds another layer of complexity. Positioned as an investment arm and ethical steward led by the co-founder, it appears to be involved in funding some initiatives (like the Sona College grant). However, its governance, funding sources, investment criteria, and overall influence on the ecosystem’s direction are opaque based on public information, making its exact function and impact difficult to assess externally.

VIII. Community Sentiment and Scam Allegations

Public perception and community discussion surrounding Dynex are highly polarized, marked by both enthusiasm for its technological vision and serious allegations questioning its legitimacy.

A. Online Discussions (Reddit, etc.)

Forums like Reddit reveal a divided community 27:

- Positive Sentiment: Some users express excitement about the PoUW concept, viewing it as a more sustainable and valuable form of mining.23 There are reports of profitable mining experiences and significant price gains during its peak.27 Comparisons are sometimes drawn to other successful PoW coins like Kaspa (KAS), suggesting high potential returns.27 The project’s ambition to solve real-world problems resonates with some users 27, and the “fair launch” narrative is often cited positively.70

- Negative Sentiment / Skepticism: A significant portion of the discussion involves direct accusations of Dynex being a scam.38 Key concerns repeatedly raised include the anonymity of the core team, the lack of transparency regarding the technology (especially the closed-source DynexSolve), doubts about the feasibility and verification of PoUW, and the perceived high risk associated with the project.25 Some dismiss positive posts as promotional shilling or “subtle adverts”.70

B. Specific Scam Allegations

The scam allegations against Dynex are not merely generic FUD (Fear, Uncertainty, Doubt) but often point to specific issues:

- Daniel Mattes Link: The most prominent and recurring allegation is the claim that Daniel Mattes, despite his SEC settlement history for investor fraud at Jumio, is the hidden founder or driving force behind Dynex.25 This connection, if true, immediately raises serious red flags due to his past actions.

- Plagiarism Claims: A specific incident involves allegations that a promotional video used by Dynex was a direct copy of a video from another entity called “DeepQ AI,” identified through identical Adobe Stock footage serial numbers.42 It was further claimed that Dynex removed its video after these allegations surfaced online, without public explanation.43 Such an incident, if accurately reported, suggests deceptive marketing practices or a lack of original content creation, undermining trust.

- Technological Opacity: The scam narrative is often intertwined with the lack of transparency surrounding the core technology. The reliance on the closed-source DynexSolve algorithm and the opaque PoUW verification process makes it impossible for independent experts to validate the project’s fundamental claims.25 Skeptics argue that this opacity could be used to hide a lack of substance or even fraudulent activity.

C. Sentiment Analysis

The combination of these specific allegations – concerning alleged founder identity and history, potential intellectual property issues (plagiarism), and fundamental technological transparency – makes the scam concerns surrounding Dynex more substantial than typical crypto project skepticism. The project faces a significant credibility gap.

The polarization in the community reflects this. Detractors point to verifiable issues like the SEC settlement related to the alleged founder and the verifiable lack of open-source code for critical components. In contrast, advocates often focus on the project’s ambitious narrative, the theoretical potential of PoUW and neuromorphic computing, and past price performance. The project has seemingly failed to provide sufficient concrete, verifiable evidence to adequately address and neutralize the specific, fact-based concerns raised by skeptics.

IX. Conclusion: Reliability Assessment and Risk Factors

Based on the comprehensive analysis of the available information, an assessment of the Dynex (DNX) project’s reliability and associated risks can be formulated.

A. Synthesis of Findings

Dynex presents an ambitious vision of decentralized neuromorphic quantum computing powered by a PoUW blockchain. It has established a public presence with two websites, a listed team, numerous partnership announcements, and a native token (DNX) traded on several exchanges. Key positive points include the stated “fair launch” principle (no ICO/premine) and reported security audits showing no critical or medium flaws in the audited (though limited scope) components.

However, these positive aspects are overshadowed by significant concerns and red flags:

- Leadership: Persistent, specific allegations link the project to Daniel Mattes, whose documented SEC settlement for investor fraud raises serious credibility issues. The project has not adequately addressed these claims.

- Technology: The core DynexSolve algorithm and PoUW mechanism are proprietary and closed-source, preventing independent verification of the project’s fundamental technological claims and security. The feasibility of their approach to neuromorphic emulation and PoUW verification remains unproven.

- Transparency: A general lack of transparency pervades the project, from the core codebase to the PoUW task/verification process and potentially the true team structure.

- Market: DNX has experienced extreme volatility and a massive price decline from its peak, with relatively low liquidity and absence from top-tier exchanges.

- Adoption: While many partnerships are announced, their commercial substance and the extent of actual paid usage of the platform are unverified.

- Reputation: The project is heavily associated with specific scam allegations, including potential plagiarism.

B. Reliability Assessment

Reliability in the context of a cryptocurrency project implies trustworthiness, transparency, technological soundness, and a reasonable expectation of operational integrity. Based on the evidence analyzed, the Dynex project cannot be considered highly reliable at this time.

The significant gap between the project’s revolutionary claims and the lack of verifiable, independent evidence supporting them is a major issue. The reliance on closed-source, proprietary technology for its most critical functions forces participants to operate largely on trust. This trust is severely undermined by the unresolved questions surrounding the project’s leadership and the specific, documented history of the individual alleged to be involved. The combination of technological opacity and leadership concerns creates an environment where assessing true reliability is exceptionally difficult.

C. Key Risk Factors

Potential investors, miners, users, or partners should be aware of the following key risks associated with the Dynex project:

- Leadership Risk: The unresolved allegations linking Daniel Mattes to the project, coupled with his history of settling SEC charges for investor fraud, represent a critical risk regarding governance, transparency, and ethical conduct.

- Transparency Risk: The closed-source nature of core components (DynexSolve, L1 consensus) prevents independent validation and auditing, creating risks of hidden flaws, backdoors, or misrepresentation. The PoUW process and team structure also lack clarity.

- Technological Risk: The feasibility of Dynex’s claimed neuromorphic/quantum emulation on GPUs and its proprietary PoUW mechanism is unverified by independent, peer-reviewed sources. The project may fail to deliver on its core technological promises. The inherent challenges of PoUW verification remain unaddressed publicly.

- Market Risk: DNX exhibits extreme price volatility, low trading volume, and limited liquidity, making it a high-risk asset. The lack of listing on major exchanges further compounds this risk.

- Execution Risk: Given the transparency issues and potential leadership concerns, there is significant uncertainty regarding the team’s ability to execute its ambitious roadmap, including the development and release of the Apollo and Athene chips.

- Reputational Risk: The project is significantly tainted by specific scam allegations and potential plagiarism, which could hinder future adoption, partnerships, and exchange listings.

D. Is it a Scam? Is it Reliable?

Addressing the user’s core questions directly:

- Is it a scam? While a definitive legal determination of “scam” is beyond the scope of this analysis, the Dynex project exhibits multiple, significant red flags strongly associated with fraudulent or highly misleading ventures in the cryptocurrency space. These include: specific allegations tying the project to an individual with a history of investor fraud, a lack of transparency in core technology, potentially plagiarized marketing materials, and unverified claims regarding partnerships and technological capabilities. The confluence of these factors places Dynex in a high-risk category where the possibility of it being a scam cannot be dismissed.

- Is it reliable? Based on the available evidence and the significant risks identified – particularly concerning leadership integrity and technological transparency – the Dynex project cannot be assessed as reliable. The foundational elements requiring trust (leadership, core technology) are precisely where the most significant questions and lack of verifiable information lie.

Potential engagement with the Dynex project should only be considered with a full understanding and acceptance of these substantial risks. Thorough due diligence and a high tolerance for potential loss are prerequisites.

Understanding the intricacies of projects like Dynex, with their complex technology and debated origins, often benefits from shared knowledge and discussion. If you found this analysis insightful, consider passing it along to friends or colleagues who are also navigating the evolving landscape of cryptocurrency, decentralized computing, or high-risk, high-reward technology ventures. Spreading awareness and fostering informed conversation helps everyone better assess the potential and pitfalls within this dynamic space.

Works cited

- Dynex, accessed on April 20, 2025, https://dynexcoin.org/

- Dynex Quantum Computing – Dynex, accessed on April 20, 2025, https://dynex.co/learn/n-quantum-computing

- Tokenomics – Dynex, accessed on April 20, 2025, https://dynexcoin.org/learn/tokenomics

- Dynex – Cryptocurrencies – IQ.wiki, accessed on April 20, 2025, https://iq.wiki/wiki/dynex

- Dynex Capital, Inc. (DX), accessed on April 20, 2025, https://www.dynexcapital.com/

- About Us – Leadership Team – Dynex Capital, Inc., accessed on April 20, 2025, https://www.dynexcapital.com/about-us/leadership-team/default.aspx

- Leadership – Dynex Capital, Inc., accessed on April 20, 2025, https://www.dynexcapital.com/about/leadership

- Dynex Technologies — ELISA Testing Systems | Dynex Technologies, accessed on April 20, 2025, https://www.dynextechnologies.com/

- Contact Dynex Technologies, accessed on April 20, 2025, https://www.dynextechnologies.com/contact-us

- Leadership – Dynex Technologies, accessed on April 20, 2025, https://www.dynextechnologies.com/leadership

- High Pressure Hydraulics: Piston Pumps, Power Units, Motors and Valves – Dynex/Rivett Inc., accessed on April 20, 2025, https://www.dynexhydraulics.com/

- Dynex White Papers, accessed on April 20, 2025, https://www.dynexhydraulics.com/dynex-white-papers/

- Dynex News, accessed on April 20, 2025, https://www.dynexhydraulics.com/about-us/news/

- Dynex High Power Semiconductors and Power Assemblies, accessed on April 20, 2025, https://www.dynexsemi.com/

- Dynex U.S.A., accessed on April 20, 2025, https://dynexusa.com/

- Dynex Energy: Investing with Energy, accessed on April 20, 2025, https://www.dynex-energy.com/

- Dynex Battery – Designed for India, accessed on April 20, 2025, https://www.dynexbattery.com/

- Dynex 50 Pack CD / DVD White Paper Plastic Sleeves Open Box | eBay, accessed on April 20, 2025, https://www.ebay.com/itm/365036385612

- What is Dynex (DNX)| How To Get & Use Dynex – Bitget, accessed on April 20, 2025, https://www.bitget.site/price/dynex/what-is

- Dynex price today, DNX to USD live price, marketcap and chart | CoinMarketCap, accessed on April 20, 2025, https://coinmarketcap.com/currencies/dynex/

- Dynex network to build human-like brain on blockchain – CoinGeek, accessed on April 20, 2025, https://coingeek.com/dynex-network-to-build-human-like-brain-on-blockchain-video/

- dynexcoin/Dynex-Whitepaper: With the end of Moore’s law approaching and Dennard scaling ending, the computing community is increasingly looking at new technologies to enable continued performance improvements. A neuromorphic computer is a nonvon Neumann computer whose structure and function are inspired by biology and physics. Today, such systems can be built and operated – GitHub, accessed on April 20, 2025, https://github.com/dynexcoin/Dynex-Whitepaper

- Revolutionizing GPU Mining with AI: The Dynex Project, accessed on April 20, 2025, https://www.toolify.ai/ai-news/revolutionizing-gpu-mining-with-ai-the-dynex-project-681505

- Dynex [DNX] dynexcoin – GitHub, accessed on April 20, 2025, https://github.com/dynexcoin

- About the risk warning of Dynex and the consideration of the feasibility of implementation | 陈剑Jason on Binance Square, accessed on April 20, 2025, https://www.binance.com/en/square/post/935045

- Dynex SDK, accessed on April 20, 2025, https://dynex.co/learn/dynex-sdk

- Missed KAS? Don’t miss DNX! DNX WILL MAKE YOU RICH! : r/EtherMining – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/EtherMining/comments/1bpr1ln/missed_kas_dont_miss_dnx_dnx_will_make_you_rich/

- Dynex n.quantum computing, accessed on April 20, 2025, https://dynex.co/

- Wallets – Dynex, accessed on April 20, 2025, https://dynexcoin.org/learn/wallets

- Whitepapers – Dynex, accessed on April 20, 2025, https://dynexcoin.org/learn/dynex-whitepapers

- Team & Advisors – Dynex, accessed on April 20, 2025, https://dynexcoin.org/learn/team-advisors

- Leadership & Team – Dynex, accessed on April 20, 2025, https://dynex.co/learn/leadership

- Partnerships & Customers – Dynex, accessed on April 20, 2025, https://dynex.co/learn/partnerships-customers

- Dynex Honored with Multiple Renowned Awards and Nominations, Showcasing Leadership in Quantum Computing – GlobeNewswire, accessed on April 20, 2025, https://www.globenewswire.com/news-release/2025/01/24/3014699/0/en/Dynex-Honored-with-Multiple-Renowned-Awards-and-Nominations-Showcasing-Leadership-in-Quantum-Computing.html

- Daniela Herrmann Serial Entrepreneur and Co-Founder of Dynex & Mission Leader of Dynex Moonshots – Smau, accessed on April 20, 2025, https://www.smau.it/speakers/daniela.herrmann

- Daniela Herrmann – Web Summit, accessed on April 20, 2025, https://websummit.com/attendees/lis24/48058625-3f31-418e-9de2-7e66d39e9430/daniela-herrmann/

- CNBC Arabia Interviews Dynex Co-Founder Daniela Herrmann – YouTube, accessed on April 20, 2025, https://www.youtube.com/watch?v=ril1lrMByqI

- DNX or KAS ? : r/gpumining – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/gpumining/comments/15kmdhg/dnx_or_kas/

- Thread ‘New work discussion – 2’ – What is climateprediction.net (CPDN)?, accessed on April 20, 2025, https://main.cpdn.org/forum_thread.php?id=9149&postid=69625

- Thread ‘World Community Grid mostly down for 2 months while transitioning’, accessed on April 20, 2025, https://main.cpdn.org/forum_thread.php?id=9119&postid=69524

- dynex · GitHub Topics, accessed on April 20, 2025, https://github.com/topics/dynex?o=asc&s=forks

- ares-austria/DynexSolve: Is Dynex from Daniel Mattes? – GitHub, accessed on April 20, 2025, https://github.com/ares-austria/DynexSolve

- PoW track is back in fashion, Dynex is on fire, but the price of the currency has syrocketed by dozens of times, and the community is questioning it | 呆哥 on Binance Square, accessed on April 20, 2025, https://www.binance.com/en-TR/square/post/948730

- 关于对Dynex的风险提示,以及落地可行性的推敲 – Jason chen, accessed on April 20, 2025, https://jason.mirror.xyz/GsydsaXbk-dD1y6eq9-C3-7QjJ5TOBMLcoH4NUyvxA8

- Daniel Mattes – Wikipedia, accessed on April 20, 2025, https://en.wikipedia.org/wiki/Daniel_Mattes

- Jumio Inc. Founder Daniel Mattes Charged with Defrauding Investors, accessed on April 20, 2025, https://www.theracetothebottom.org/rttb/2019/7/28/jumio-inc-founder-daniel-mattes-charged-with-defrauding-investors

- SEC Charges Former CEO of Silicon Valley Startup With Defrauding Investors, accessed on April 20, 2025, https://www.sec.gov/newsroom/press-releases/2019-50

- Daniel Mattes – SEC.gov, accessed on April 20, 2025, https://www.sec.gov/enforcement-litigation/litigation-releases/lr-24440

- Former Tech Exec Settles with SEC – CFO.com, accessed on April 20, 2025, https://www.cfo.com/news/former-tech-exec-settles-with-sec/657982/

- Daniel Mattes – SEC.gov, accessed on April 20, 2025, https://www.sec.gov/files/litigation/complaints/2019/comp-pr2019-50.pdf

- Ex-Jumio CEO Daniel Mattes settles with SEC – PE Hub, accessed on April 20, 2025, https://www.pehub.com/ex-jumio-ceo-daniel-mattes-settles-with-sec/

- Jumio founder agrees $17.4m settlement amid SEC fraud claims – The New Economy, accessed on April 20, 2025, https://www.theneweconomy.com/business/jumio-founder-agrees-17-4m-settlement-amid-sec-fraud-claims

- Official Statement: SEC Settles with Former Jumio Executives, accessed on April 20, 2025, https://www.jumio.com/about/press-releases/official-statement-sec-jumio-executives/

- Dynex Price, DNX Price, Live Charts, and Marketcap – Coinbase, accessed on April 20, 2025, https://www.coinbase.com/price/dynex

- Dynex Price: DNX Live Price Chart, Market Cap & News Today …, accessed on April 20, 2025, https://www.coingecko.com/en/coins/dynex

- A first Look At Dynex SDKs & PoUW – YouTube, accessed on April 20, 2025, https://www.youtube.com/watch?v=bTiz2k4Pt18

- Proof-of-Learning with Incentive Security – arXiv, accessed on April 20, 2025, https://arxiv.org/html/2404.09005v7

- arXiv:2504.07540v1 [cs.LG] 10 Apr 2025, accessed on April 20, 2025, https://arxiv.org/pdf/2504.07540

- PoGO: A Scalable Proof of Useful Work via Quantized Gradient Descent and Merkle Proofs, accessed on April 20, 2025, https://arxiv.org/html/2504.07540v1

- Challenges of Proof-of-Useful-Work (PoUW) – arXiv, accessed on April 20, 2025, https://arxiv.org/pdf/2209.03865

- All you want to know about Dynex, accessed on April 20, 2025, https://dynex.co/learn/links

- What is the advantage of adding research papers to arxiv before publishing in a journal or conference? | ResearchGate, accessed on April 20, 2025, https://www.researchgate.net/post/What_is_the_advantage_of_adding_research_papers_to_arxiv_before_publishing_in_a_journal_or_conference

- [D] Why do people upload their work on Arxiv, not submitting conference? – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/MachineLearning/comments/1bya23i/d_why_do_people_upload_their_work_on_arxiv_not/

- CRYPTO REVIEW: Dynex Coin( $DNX ), accessed on April 20, 2025, https://web.ourcryptotalk.com/blog/dynex-coin-review

- Dynex Price Today | DNX USD Price Live Chart & Market Cap – DropsTab, accessed on April 20, 2025, https://dropstab.com/coins/dynex

- Dynex live price in USD — today’s Live Value of DNX (Current Rate) on 3commas.io, accessed on April 20, 2025, https://3commas.io/coin-price-chart/dynex-usd

- Dynex Price | DNX to USD Converter, Chart and News – Binance, accessed on April 20, 2025, https://www.binance.com/en/price/dynex

- Dynex USD (DNX-USD) Stock Price, News, Quote & History – Yahoo Finance, accessed on April 20, 2025, https://ca.finance.yahoo.com/quote/DNX-USD?p=DNX-USD

- Dynex Price, DNX Price, Live Charts, and Marketcap – Coinbase, accessed on April 20, 2025, https://www.coinbase.com/en-sg/price/dynex

- Dynex : r/CryptoCurrency – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/CryptoCurrency/comments/14bi4yi/dynex/

- Dynex (DNX) – Price, Chart, Info – CryptoSlate, accessed on April 20, 2025, https://cryptoslate.com/coins/dynex/

- Dynex Price, DNX Price, Live Charts, and Marketcap – Coinbase, accessed on April 20, 2025, https://www.coinbase.com/en-it/price/dynex

- Analyze DNX Popularity: Dynex Reddit, X & GitHub – BitDegree, accessed on April 20, 2025, https://www.bitdegree.org/cryptocurrency-prices/dynex-dnx-price/popularity

- Dynex Smart Contract Audit | Cyberscope, accessed on April 20, 2025, https://www.cyberscope.io/audits/dnx

- Cyberscope | Smart Contract Audits, accessed on April 20, 2025, https://www.cyberscope.io/

- audits/dnx/audit.pdf at main · cyberscope-io/audits · GitHub, accessed on April 20, 2025, https://github.com/cyberscope-io/audits/blob/main/dnx/audit.pdf

- website/Dynex-whitepaper.pdf at main – GitHub, accessed on April 20, 2025, https://github.com/dynexcoin/website/blob/main/Dynex-whitepaper.pdf

- Partnerships & Customers – Dynex, accessed on April 20, 2025, https://dynexcoin.org/learn/partnerships-customers

- Dynex Ecosystem, accessed on April 20, 2025, https://dynex.co/learn/ecosystem

- Is this mining rig worth anything? More info in comments : r/EtherMining – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/EtherMining/comments/1fzadqc/is_this_mining_rig_worth_anything_more_info_in/

- This time there is an interesting change in crypto conversations : r/CryptoCurrency – Reddit, accessed on April 20, 2025, https://www.reddit.com/r/CryptoCurrency/comments/19c1uaa/this_time_there_is_an_interesting_change_in/